Everything about Home Loans Brokers Melbourne

Wiki Article

What Does Home Loans Brokers Melbourne Mean?

Table of ContentsHome Loans Melbourne Can Be Fun For AnyoneWhat Does Home Loans Brokers Melbourne Mean?Melbourne Home Loans - TruthsAbout Home Loans Melbourne

If a consumer pays out or re-finances their home mortgage within 2 years, a lender can enforce a "Clawback" provision upon a Mortgage Broker, forcing the Broker to pay back their ahead of time commission. While this upsets many Home mortgage Brokers, it can function in the favour of the consumer, making certain the Home mortgage Broker places your financing with a financial institution that you will certainly enjoy with, else they will certainly have to pay their compensation back.On a $500,000 financing, they would obtain about $3,250 ahead of time payment + $750 p. a. trail. Due to the fact that of the compensation paid by the bank, the bulk of Home loan Brokers in Australia bill $0.

Test them before you commit and provide 'suppose' scenarios to see if they can assume outside the box.

Some Known Incorrect Statements About Melbourne Home Loans

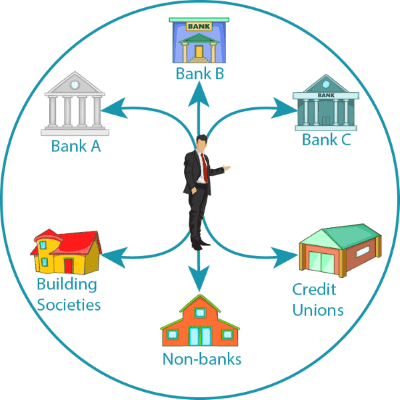

Whether you're an initial home customer trying to find assistance nailing your application, or a veteran financier hunting for the most competitive deal, you might be thinking about engaging with a home mortgage broker for skilled guidance and assistance. Yet you may be curious regarding exactly how mortgage brokers obtain paid - especially as their solutions ought to be free to you.Commonly, it ought to not cost you anything to function with a home loan broker. In Australia, home loans melbourne numerous home mortgage brokers use mortgage suggestions and suggestions to customers without billing them a cent. melbourne home loans. Some brokers might charge fees to cover the expenditures involved in refining your home mortgage applications, yet except providing their core broking solutions

Even more, if you can not afford a home mortgage and default on your settlements, the broker would lose their route payment. melbourne home loans. A mortgage broker can work out with a lending institution on your part, and obtain you reduced rates of interest, forgoed fees or added bundled services for your home mortgage. While marked down home mortgage make less cash for lenders, numerous banks will certainly still use brokers the very same payments anyhow, as they identify the worth of the broker introducing them to new customers

Melbourne Home Loans - An Overview

However, they aren't always legally obliged to advise the cheapest possible home mortgage, or car loans that pay less payment. Don't be timid concerning asking your home mortgage broker exactly how they're paid, and what commissions they'll obtain from various lenders for recommending their financings. Locate out if there are other options readily available that can better match your financial resources Pay the broker a reduced compensation.Some home mortgage brokers aren't paid commissions and rather charge costs to borrowers for their solutions. These brokers might be able to advise lenders that brokers do not (e. g. smaller loan providers that do not pay compensations to brokers), and might be able to use an extra personalised degree of solution. It's worth keeping in mind that locating a fee-based broker can be tough, as many of the Australian mortgage broking industry is compensation based, making it much a lot more financially challenging for fee-based brokers to run.

A mortgage broker additionally considers market conditions, both for today and in the future. Not all mortgage brokers are made equal, however the most effective representatives offer you these critical advantages: They do this for a living, and you'll discover the most effective loan for your specific needs. Mortgage brokers tend to be well-connected with banks and lenders, so you might locate bargains you would not see elsewhere.

It gives you a reasonable deal. Mortgage brokers know a point or 2 about sound economic preparation. melbourne home loans. They can encourage you on the very best relocations and plans to make in your sector. Their objective is to make certain you acquire the very best financing and most good terms to make sure that you can fund it in the future

A Biased View of Home Loans Brokers Melbourne

Home mortgage brokers ease this clerical task and make less mistakes than you would certainly on the types. Finance, Corp is just one of Australia's leading financing brokers and fully accredited with an Australian Credit Score Licence. We are experts, not simply with mortgage, but every finance you could require in your life time.Report this wiki page